Research and Development in the production of Craft Beers needn’t leave a bitter taste in the mouth for the brewer.

Thanks to the opportunities now available to submit applications for Research & Development Tax Relief, brewers of craft beers may well find that, whilst we enjoy their bitter, they can derive a sweet reward for their endeavours.

Craft Beers can offer great new tastes; sometimes created from the most unexpected resource and sometimes developed from traditional recipes to produce fresh, new brews that appeal to modern tastes.

Either way, an entrepreneurial brewer could now get an unexpected bonus for his efforts, from the Chancellor.

Cooden Tax Consulting specialises in offering Tax advice to a broad range of businesses, including those in the Brewing Industry, on how to go about applying for a rebate from the Tax man, against costs connected to research and development projects.

Traditional Hops for a new Craft Beer help Brewer move forward in leaps and bounds…

We’ve recently discussed this opportunity with Craft Beer World, focusing on how the R&D Tax Relief criteria might be applied to both brewers of craft beers, and to the industry’s bigger players, trying to get new flavours in to their products via experimentation with hop combinations and brewing techniques.

From The Charles Wells Brewery in Bedford comes a wonderful example of precisely the sort of project that could qualify for R&D Tax Relief. Master Brewer Chris Read explained, firstly, the research he undertook in preparation for a new IPA offering, spending:

“…a lot of time researching brewing archives, looking for traditional malt and hop recipes and working out how best to evolve them for modern tastes”

Barley malt and hop cones

and, secondly, the development work undertaken with those providing the raw ingredients:

“Working with our hops suppliers, I arrived at a blend of Galaxy, Simcoe and Goldings Hops, alongside various lighter malts, to create a traditionally bitter and hoppy IPA with a soft, modern, tropical flavour” *

Whether or not Charles Wells have as yet examined the opportunity, this approach encapsulates the kind of work that could qualify for R&D tax relief, but others have gone even further and, where R&D projects in Brewing may additionally involve the recycling of otherwise wasted foodstuffs, there’s potentially a double diamond to be found in the rough.

Bread Beer on the rise

Brewing is a competitive industry which constantly has to address the public’s thirst for new flavours and products. In an environment like this opportunities to research raw ingredients and try out new production methods and taste combinations are almost inexhaustible. Sometimes, something unexpected emerges…

Friday Night Feast, Channel 4’s current exploration in to the offbeat and less well known culinary world, hosted by foodies and passionate environmentalists Jamie Oliver and Jimmy Doherty, recently aired the duo’s investigation in to Toast Ale, brewed by Tristam Stuart and Jon Swain at The Hackney Brewery.

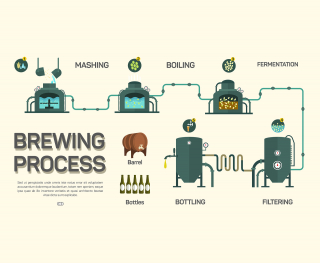

Having come across the idea in Belgium, Hackney Brewery sources left over, fresh bread from artisan bakeries, then slices, toasts and mashes it, adding the breadcrumbs to malted barley, a mixture of hops, yeast and water.

Toast Ale uses left over Artisan Bread as a substitute for yeast in their brewing process

Profits from the sale of the ale, which is stocked in a number of different outlets in the UK, go to “Feedback” an environmental organisation that campaigns to end food waste.

Thus, the Hackney Brewery has more than one reason to examine recouping some of their costs via an application for Research and Development Tax Relief and we, whilst enjoying their ale, can toast our small contribution to a very good cause. **

Fermenting a Cider Revolution

Craft ciders are no longer limited to fermenting the humble apple or pear, although blending different varieties of those fruits remains an exciting challenge, but also includes production of a host of lip-smacking and tantalising brews, such as ciders made from blood oranges, elderflowers or even kiwi and lime. ***

All can be bottled in different styles, depending, among other things, on whether the fruit is subjected to a first or second fermentation.

A registered small business, incurring costs associated with such experimentation, may very well be able to recover some of those costs via R&D Tax Relief.

Advice on tap…

At Cooden Tax Consulting we feel it’s time to roll out the barrel and ensure that inventive brewers, creating craft beers like those described above, for everyone’s enjoyment, have an opportunity to drink their full at the Tax man’s well. Which business owner wouldn’t raise a glass to that?

Applying for Research & Development Tax Relief isn’t straightforward, but tap in to our expertise and you won’t be left high and dry.

Cooden Tax Consulting is a Niche Tax Consultancy specialising in R&D Tax Relief. We offer a free no obligation consultation to determine whether any projects might be eligible, to explain our services in more detail and discover how our expertise can best serve your business. Please call us on 01424 225345 and ask to speak to Simon or e-mail simon@coodentaxconsulting.co.uk

For further reading, here are links to all the sources quoted in this article:

Simon Bulteel is the owner and Managing Director of Cooden Tax Consulting, a division of Cooden Consulting Limited. A niche tax consultancy specialising in Research and Development Tax Relief, Patent Box...

The following Cookies are used on this Site. Users who allow all the Cookies will enjoy the best experience and all functionality on the Site will be available to you.

You can choose to disable any of the Cookies by un-ticking the box below but if you do so your experience with the Site is likely to be diminished.

In order to interact with this site.

To help us to measure how users interact with content and pages on the Site so we can make

things better.

To show content from Google Maps.

To show content from YouTube.

To show content from Vimeo.

To share content across multiple platforms.

To view and book events.

To show user avatars and twitter feeds.

To show content from TourMkr.

To interact with Facebook.

To show content from WalkInto.