Welcome to our round up of the latest business news for our clients. Please contact us if you want to talk about how these updates affect your business. We are here to support you!

A company might have a great product or service but without a business growth strategy to help it define, articulate, and communicate where it is going, it may not grow at all!

A growth strategy starts with identifying and accessing opportunities within your market. The strategy addresses how your company is going to evolve to meet the challenges of today and in the future. A growth strategy gives your company purpose, and it answers questions about your long-term plans.

Having a growth strategy is important because it keeps your company working towards goals that go beyond what is happening in the market today. It will keep both owners and employees focused and aligned, and will allow you to think long-term.

The first step is to look at five important areas that will help you develop a growth strategy:

Once you have taken some time to write out your growth strategy and where you want your business to be in (say) 2 years, the next step is to work out your marketing plan.

A marketing plan is a business document outlining your marketing strategy and tactics. It is often focused on a specific period of time (i.e., over the next 12 months) and covers a variety of marketing-related details, such as costs, goals, and action steps. But like your business plan, a marketing plan is not a static document. It should outline:

Please talk to us about helping you formulate your expansion plans; we have considerable experience in helping our clients grow their businesses.

Making Tax Digital (MTD) for Income Tax will require businesses to keep digital accounting records and submit quarterly returns to HMRC. These changes will apply to businesses, self-employed individuals and landlords with turnover over £50,000 from 6 April 2026. Those with turnover above £30,000 will be mandated to comply from 6 April 2027 and other businesses and landlords may be mandated at a later date.

Since MTD was announced, we have been working with many of our clients to help them streamline the way they keep their books and help them prepare for digital bookkeeping ahead of the law change. If you haven’t moved your bookkeeping onto a digital package then please talk to us.

Just suppose you:

We can help you put in a cloud accounting package and get you:

Please talk to us about the advantages of a cloud accounting package, you will be amazed what a difference knowing your results in real time makes to your business!

Innovation has generally been recognised as essential for value creation, both for individual companies and for the UK economy as a whole. The development of new ideas, processes, and technologies and their flow across different sectors is a significant driver of economic growth and productivity. Recently, innovation has also been identified as crucial to the transition of the economy away from fossil fuels and carbon-intensive business activities.

There are many factors that affect whether and how businesses innovate, for example the availability of skills, capital, and government policy measures such as tax incentives.

However, none are more important that the company’s own culture, capabilities, and internal systems – all of which are aspects of its governance. Unless companies are governed in a way that is conducive to innovation, they are unlikely to be in a position to take advantage of new opportunities.

Our most innovative clients share some key characteristics:

Research and Development (R & D) is the process of taking an idea and transforming it into a fully-fledged product or procedure. R & D tax credits are a government incentive designed to encourage innovation across multiple industries. This is an opportunity for you to reduce your corporation tax bill or receive a refund from HMRC based upon the number of working hours and relevant costs your business dedicates to Research & Development.

If you are looking for long term finance to support innovation then you will need to ensure your management accounts are up to date, you make available current detailed lists of debtors and creditors, and you might need up to date projections before an expert will consider your application.

Please talk to us about R & D tax credits and long term finance; our independent experts have many years of experience and success in advising business across a wide range of sectors.

Listed below are a number of live HMRC webinars that will help employers with payroll. The webinars are free and last around an hour:

Expenses and benefits for your employees – phones, internet, and homeworking

Tue 27 Jun at 11:45am

Expenses and benefits for your employees - if your employees have more than one workplace

Fri 16 Jun at 11:45am

Expenses and benefits for your employees - travel

Fri 23 Jun at 9:45am

Company directors - payroll and you

Mon 5 Jun at 9:45am

Expenses and benefits for your employees - company cars, vans, and fuel

Thu 15 Jun at 11:45am

Expenses and benefits for your employees - social functions and parties

Fri 9 Jun at 9:45am

Expenses and benefits for your employees - trivial benefits

Thu 8 Jun at 9:45am

Statutory Maternity and Paternity Pay

Wed 7 Jun at 11:45am

Statutory Sick Pay

Tue 6 Jun at 9:45am

See: HMRC email updates, videos and webinars for employing people - GOV.UK (www.gov.uk)

Cyber Essentials is a Government backed scheme that will help you to protect your organisation, whatever its size, against a whole range of the most common cyber-attacks.

Cyber-attacks come in many shapes and sizes, but the vast majority are very basic in nature, carried out by relatively unskilled individuals. They’re the digital equivalent of a thief trying your front door to see if it’s unlocked. Our advice is designed to prevent these attacks.

Cyber Essentials

This self-assessment option gives you protection against a wide variety of the most common cyber-attacks. This is important because vulnerability to basic attacks can mark you out as target for more in-depth unwanted attention from cyber criminals and others.

Certification gives you peace of mind that your defences will protect against the vast majority of common cyber-attacks simply because these attacks are looking for targets which do not have the Cyber Essentials technical controls in place.

Cyber Essentials shows you how to address those basics and prevent the most common attacks.

Cyber Essentials Plus

Cyber Essentials Plus still has the Cyber Essentials trademark simplicity of approach, and the protections you need to put in place are the same, but for Cyber Essentials Plus, a hands-on technical verification is carried out.

See: About Cyber Essentials - NCSC.GOV.UK

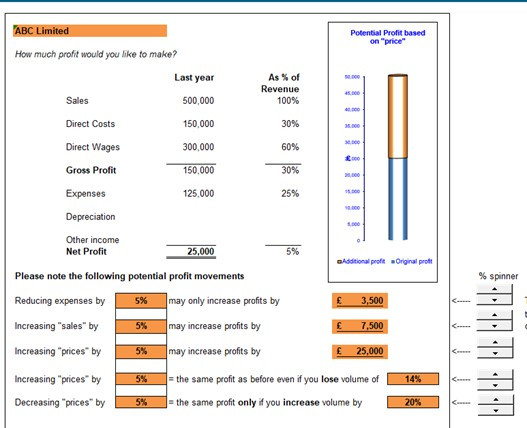

Or maybe increased the number of customers, reduced expenses or even decreased prices? Do you know the effect of these changes to your bottom line?

Successful businesses right now have one thing in common – they are prepared to make fast changes to their plans!

With the Cost of living and strikes weighing in on the economy, flexibility is the key attribute needed to survive and prosper in uncertain times.

Just suppose we could show you movements on profit when flexing key variables with a simple but effective tool called “Business Analyst”.

Together we could enter your current figures such as turnover, direct costs such as materials and labour, and expenses, then analyse the effect of rising costs and inflation and their impact on your business. We could then examine key performance indicators and look at all the options such as the impact of a price rise or reduction, increasing sales or reducing expenses to help you maximise your profit, and set targets of where you want your business to be in twelve months. We can look at a range of “What if Scenarios” and set a strategy for success.

Talk to us about how we can work together on your business and stay ahead of the curve!

Innovate UK is offering up to £25 million in loans to micro, small and medium-sized enterprises (SMEs). Loans are for highly innovative late-stage research and development (R&D) projects with the best potential for the future. There should be a clear route to commercialisation and economic impact.

Your project must lead to new products, processes or services that are significantly ahead of others currently available or propose an innovative use of existing products, processes, or services. It can also involve a new or innovative business model.

Innovate UK are particularly interested in projects that focus on the future economy areas included in the Innovate UK plan for action.

You must be able to show that you:

The funding available will be allocated across a series of competitions:

The Energy Bills Discount Scheme (EBDS) is for non-domestic customers that use energy provided by licence-exempt suppliers, where prices paid are pegged to wholesale prices. This is energy taken from the public electricity or gas grid, or received via wire or pipe. The scheme will provide support between 1 April 2023 to 31 March 2024. Further information on how and when to apply for support under the EBDS will be published in due course.

Energy and Trade Intensive Industries (ETII)

If you’re eligible for the higher level of support to businesses and organisations, you will need to apply for this support. This is separate from the non-standard cases application process.

Non-standard customers who believe that they meet the criteria for ETII support and cannot see their energy provider listed when prompted in the application process, should contact us at support@ebds.beis.gov.uk.

Heat networks

If you’re eligible for the higher level of support for heat suppliers but receive your energy from a licence-exempt supplier, contact EBRS by emailing: ebrs.nonstandardcases@beis.gov.uk

Energy Bill Relief Scheme (EBRS)

The scheme was expanded to include non-domestic customers who receive energy from license-exempt suppliers via private wire or pipe, where prices paid are pegged to wholesale energy prices. The support covered the period 1 October 2022 until 31 March 2023.

Find out how to apply retrospectively for this support.

See: Energy Bills Discount Scheme - GOV.UK (www.gov.uk)

The Health and Safety Executive (HSE) has updated its guidance on managing health and safety for employers. Employers are responsible for managing health and safety in their business. This includes managing risks and taking practical steps to protect workers and others from harm.

Managing risk is just one part of health and safety management. You must also have arrangements in place to:

By doing this, you should be able to ensure:

The measures you put in place should be part of your everyday processes for managing your business.

For most small, low-risk businesses you don’t need a formal management system. By following a simple Plan, Do, Check, Act approach you can effectively manage health and safety in your workplace.

HSE provides information on finding the right guidance for your business outlining that the approach you take for managing health and safety will depend on the size of your business, the type of work you do, and the level of risk in your workplace.

See: Introduction to managing health and safety: Find the right guidance for your business - HSE

The following Cookies are used on this Site. Users who allow all the Cookies will enjoy the best experience and all functionality on the Site will be available to you.

You can choose to disable any of the Cookies by un-ticking the box below but if you do so your experience with the Site is likely to be diminished.

In order to interact with this site.

To help us to measure how users interact with content and pages on the Site so we can make

things better.

To show content from Google Maps.

To show content from YouTube.

To show content from Vimeo.

To share content across multiple platforms.

To view and book events.

To show user avatars and twitter feeds.

To show content from TourMkr.

To interact with Facebook.

To show content from WalkInto.